Why Choose an Investment Fiduciary?

An investment fiduciary acts in a professional capacity of trust and manages property for the benefit of another. The obligations of investment fiduciaries are precisely specified by law, such as the Uniform Prudent Investor Act and the Employee Retirement Income Security Act. The role of an investment fiduciary is fulfilled by recommending financial planning and investment strategies that are in the best interests of the client. Grossman Financial Management (GFM) is a Registered Investment Advisor and provides financial planning and investment advisory services on a fee-only basis. As such, we serve clients as investment fiduciaries.

An investment fiduciary acts in a professional capacity of trust and manages property for the benefit of another. The obligations of investment fiduciaries are precisely specified by law, such as the Uniform Prudent Investor Act and the Employee Retirement Income Security Act. The role of an investment fiduciary is fulfilled by recommending financial planning and investment strategies that are in the best interests of the client. Grossman Financial Management (GFM) is a Registered Investment Advisor and provides financial planning and investment advisory services on a fee-only basis. As such, we serve clients as investment fiduciaries.

GFM is not a stockbroker; stockbrokers are technically known as “broker-dealers” and/or “registered representatives”. The essential role of stockbrokers is the sale of products of a brokerage firm. By law, the provision of investment advice by a stockbroker may be no more than “solely incidental” to the sales process. Their legal responsibility to customers is met by adherence to the standards of honest dealing and, when recommending products, having “reasonable grounds for believing that the recommendation is suitable”. Stockbrokers use many titles, such as “financial planner”, “investment counselor”, “financial advisor”, “financial professional” and “financial consultant”. However, none of those titles has legal meaning.

As investment fiduciaries, GFM recommends investments that we believe are in our clients’ best interests.

Therefore, we do not recommend investments that:

- Pay us to be on our recommended list of investments

- Are from an affiliated company or “in-house” fund family

- Compensate us with gifts or “free” services

- Compensate us in any manner

Our compensation comes exclusively, directly and in a fully-disclosed manner from our clients’ fees.

Our contracts do not include a pre-dispute arbitration clause.

Therefore, we do not recommend investments that:

- Pay us to be on our recommended list of investments

- Are from an affiliated company or “in-house” fund family

- Compensate us with gifts or “free” services

- Compensate us in any manner

Our compensation comes exclusively, directly and in a fully-disclosed manner from our clients’ fees.

Our contracts do not include a pre-dispute arbitration clause.

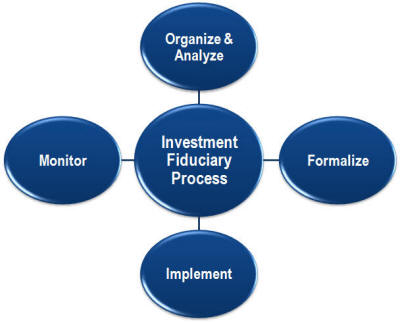

At GFM, the comprehensive financial planning process follows the standards of the Certified Financial Planner Board of Standards, the national licensing body for Certified Financial Planners. Our investment process adheres to the investment fiduciary standards promulgated by the Foundation for Fiduciary Studies. GFM’s approach to investment management emphasizes the tight integration of investing with financial planning; this is because for most people investing is a means, not an end, to achieve goals which are best reflected in a financial plan. Accordingly, each client’s investment strategy is developed optimally by stress-testing alternative investment strategies within the context of that client’s unique financial circumstances and, during implementation, investment performance is monitored in light of client goals codified in the financial plan. GFM’s investment process involves these key steps, consistent with investment fiduciary practice, in constructing institutional-style low-cost and globally diversified portfolios based upon modern portfolio theory and practice:

At GFM, the comprehensive financial planning process follows the standards of the Certified Financial Planner Board of Standards, the national licensing body for Certified Financial Planners. Our investment process adheres to the investment fiduciary standards promulgated by the Foundation for Fiduciary Studies. GFM’s approach to investment management emphasizes the tight integration of investing with financial planning; this is because for most people investing is a means, not an end, to achieve goals which are best reflected in a financial plan. Accordingly, each client’s investment strategy is developed optimally by stress-testing alternative investment strategies within the context of that client’s unique financial circumstances and, during implementation, investment performance is monitored in light of client goals codified in the financial plan. GFM’s investment process involves these key steps, consistent with investment fiduciary practice, in constructing institutional-style low-cost and globally diversified portfolios based upon modern portfolio theory and practice:

- Knowing the client’s unique financial situation and goals

- Appropriately diversifying assets to the specific risk/return profile of each client

- Preparing a specific investment policy statement

- Using prudent experts to invest funds pursuant to the client’s investment policy statement

- Accounting for and controlling investment expenses

- Continuously measuring performance relative to goals as well as taking corrective action

- Avoiding conflicts of interest and prohibited transactions

By adhering to prudent planning and investment processes, while avoiding questionable business practices, GFM improves the likelihood of providing our clients with successful financial advice. This is our commitment to our clients.

This White House report “examines the evidence on the cost of conflicted investment advice and its effects on Americans’ retirement savings, focusing on IRAs. Investment losses due to conflicted advice result from the incentives conflicted payments generate for financial advisers to steer savers into products or investment strategies that provide larger payments to the adviser but are not necessarily the best choice for the saver.” The key finding is that “conflicted advice leads to lower investment returns. Savers receiving conflicted advice earn returns roughly 1 percentage point lower each year (for example, conflicted advice reduces what would be a 6 percent return to a 5 percent return)…A retiree who receives conflicted advice when rolling over a 401(k) balance to an IRA at retirement will lose an estimated 12 percent of the value of his or her savings if drawn down over 30 years. If a retiree receiving conflicted advice takes withdrawals at the rate possible absent conflicted advice, his or her savings would run out more than 5 years earlier.” To access the complete report, click the image or here. (Page has been removed by the Trump Administration, but can be found archived here)

This SEC Report, “Study on Investment Advisers and Broker Dealers” (2011), found that “approximately 88% of Investment Adviser Representatives are also registered representatives of broker-dealers” [i.e., stock brokers]. In effect, those IARs are licensed to serve both in a fiduciary and non-fiduciary role with the same client. Not surprisingly, the Report found that “many retail investors and investor advocates submitted comments stating that retail investors do not understand the differences between investment advisers and broker-dealers or the standards of care applicable to broker-dealers and investment advisers. Many find the standards of care confusing, and are uncertain about the meaning of the various titles and designations used by investment advisers and broker-dealers. Many expect that both investment advisers and broker-dealers are obligated to act in the investors’ best interests. The Commission has sponsored studies of investor understanding of the roles, duties and obligations of investment advisers and broker-dealers that similarly reflect confusion by retail investors regarding the roles, titles, and legal obligations of investment advisers and broker-dealers”. To access the complete report, click the image or here