Investment Management

GFM’s approach to investment management emphasizes the tight integration of investing with financial planning; this is because for most people investing is a means, not an end, to achieve goals which are best reflected in a financial plan. Accordingly, each client’s investment strategy is developed optimally by stress-testing alternative investment strategies within the context of that client’s unique financial circumstances and, during implementation, investment performance is monitored in light of client goals codified in the financial plan.

GFM’s investment process involves these key steps, consistent with investment fiduciary practice, in constructing individualized, very low-cost and globally diversified portfolios based upon modern portfolio theory and practice:

- Knowing the client’s unique financial situation and goals

- Appropriately diversifying assets to the specific risk/return profile of each client

- Preparing a specific investment policy statement

- Using prudent experts to invest funds pursuant to the client’s investment policy statement

- Accounting for and controlling investment expenses

- Continuously measuring performance relative to goals as well as taking corrective action

- Avoiding conflicts of interest and prohibited transactions

Investment Management Options

| Grossman Financial Management |

Self (DIY) | Stock Broker | |

Process |

|||

| Investment Plan Quality and Thoroughness | high | low | low |

| Continuous Management of Investments to Plan | yes | unlikely | no |

| Manage Your Investments at Any Broker/Custodian You Select | yes | yes | no |

| Personalized and Attentive Service | high | 24/7 | medium |

| Standards of Accredited Investment Fiduciary | yes | no | no |

| Compensated by Client Only | yes | n/a | no |

Reporting Quality |

|||

| Measure Investment Performance | high | poor | medium |

| Measure Performance Relative to Markets | high | poor | poor |

| Measure Performance Relative to Client’s Goals | high | poor | poor |

| Accounting of Investment Expenses | high | poor | poor |

Financial Planning Integration |

|||

| Standards of Certified Financial Planner | yes | no | unlikely |

| Investment & Financial Plans Integrated | yes | no | no |

| Investment & Financial Plans Updated | yes | no | no |

| Coordination with Client’s Tax, Legal & other Advisors | yes | no | unlikely |

Investment Management Services: Value Estimates & Indicators

The following are estimates or indicators of the potential value of investment management services on annual investment returns. The sources of the estimates are publications from Vanguard, Morningstar, John C. Bogle, Standard and Poor’s, The White House Council of Economic Advisors, and others; links to the sources are provided.

Investment management, behavioral coaching up to 1.5%

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf?cbdForceDomain=true

http://corporate.morningstar.com/euconf3/presentations/David%20Blanchett,%20Morningstar.pdf

https://corp.financialengines.com/employers/FinancialEngines-2014-Help-Report.pdf

Tax, efficient asset location up to 0.8%

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf?cbdForceDomain=true

http://corporate.morningstar.com/euconf3/presentations/David%20Blanchett,%20Morningstar.pdf

Rebalancing portfolio systematically up to 0.4%

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf?cbdForceDomain=true

http://corporate.morningstar.com/euconf3/presentations/David%20Blanchett,%20Morningstar.pdf

Tax, harvesting up to 0.3%

https://www.betterment.com/resources/research/tax-loss-harvesting-white-paper/

http://corporate.morningstar.com/euconf3/presentations/David%20Blanchett,%20Morningstar.pdf

Tax, withdrawal order up to 0.8%

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf?cbdForceDomain=true

http://corporate.morningstar.com/euconf3/presentations/David%20Blanchett,%20Morningstar.pdf

Not “conflicted advice” – avoid underperformance up to -1.0%

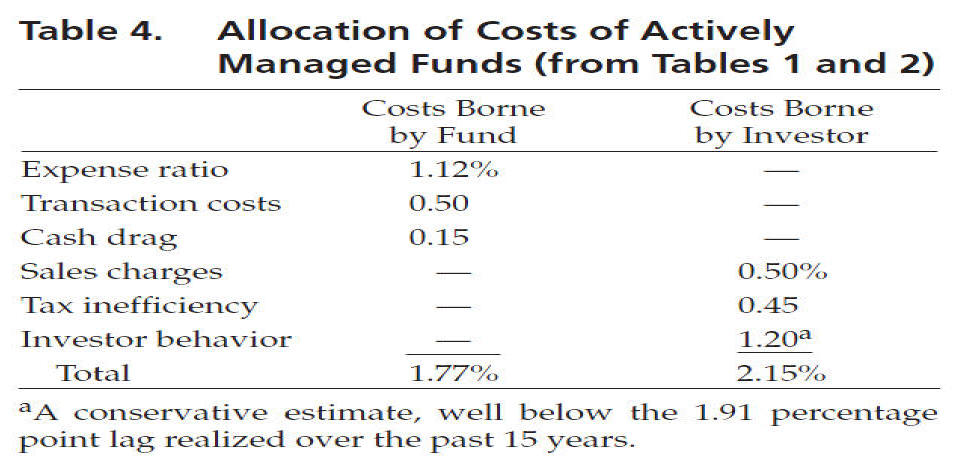

Inexpensive investment vehicles – avoid costs up to -1.1%

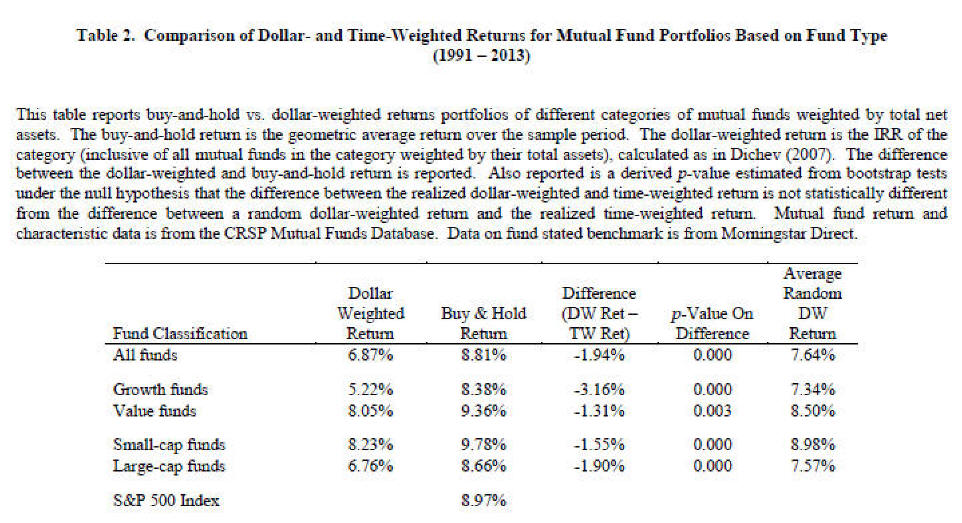

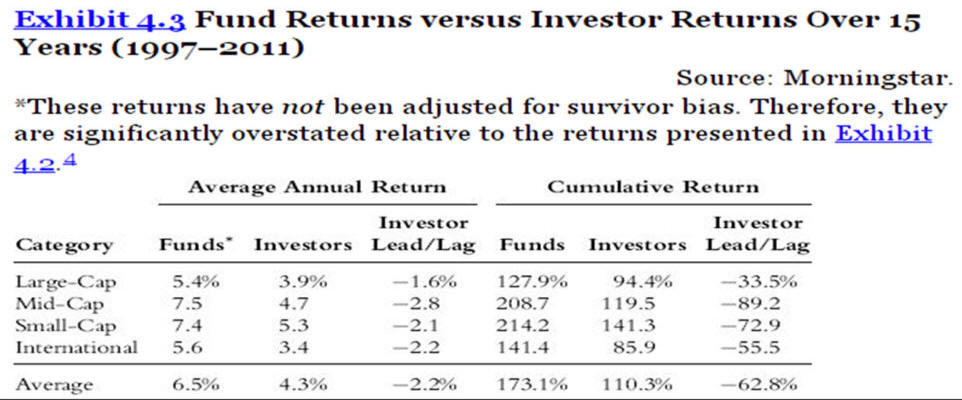

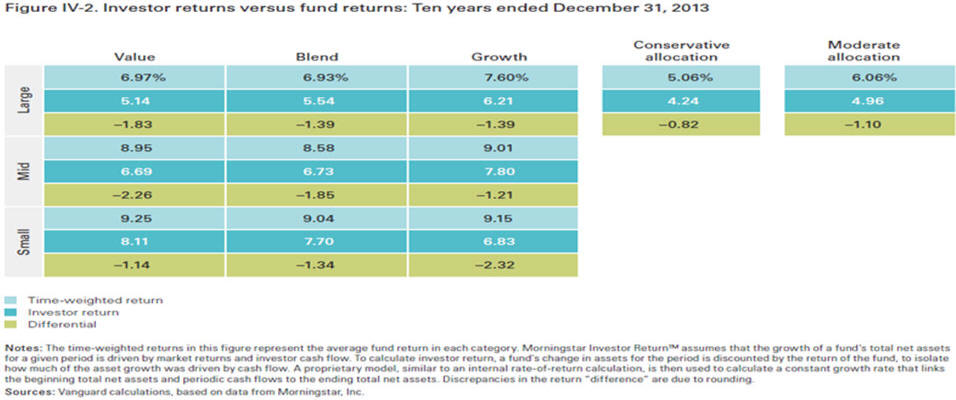

Investment Timing – avoid underperformance up to -0.8% to – 2.3%

The Clash of Cultures: Investment vs. Speculation, John C. Bogle, 2013

“The Arithmetic of “All-In” Investment Expenses”, Financial Analysts Journal, Jan-Feb 2014

http://www.morningstar.com/advisor/t/70540275/mind-the-gap-why-investors-lag-funds.htm

http://news.morningstar.com/articlenet/article.aspx?id=637022

https://advisors.vanguard.com/iwe/pdf/ISGIDX.pdf?cbdForceDomain=true

http://us.spindices.com/resource-center/thought-leadership/spiva/

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf?cbdForceDomain=true

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2560434 “Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies”; Jason Hsu, Brett W. Myer, Ryan Whitby, July 2014

source: Hsu, Myer, Whitby, “Timing Poorly”

source: John C. Bogle, Clash of Cultures

source: Vanguard, 2014

source: Morningstar

source: Morningstar

source: Vanguard, 2015

source: Bogle, 2014