During 2016, equity markets around the world logged attractive gains while returns to fixed-income investments faded during the second half of the year to end only modestly positive. In sum:

- The US stock market rose 12.0%.

- Global stocks gained 8.4%.

- Investment grade bonds returned 2.7%.

- Value strategies beat growth by 10%.

- Small cap stocks beat large cap stocks by 6%.

- Foreign stocks gained 1%.

- Emerging market stocks posted gains of 8.5%.

- Inflation was at 2.1% in the US.

GFM client portfolio returns were generally in line with the overall markets, though many specific funds also did particularly well in 2016. Your accompanying report provides details. Longer-term performance records indicate, moreover, that our portfolios are comprised of funds with continuing strong performances, and very low costs, over time.

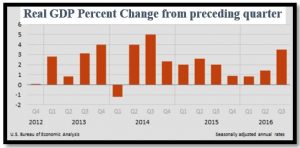

US economic growth in 2016 continued to advance at a modest pace. Traditional unemployment measures further improved, declining to 4.7%, but GDP trend growth below 2% remains in place and is low by historic standards.

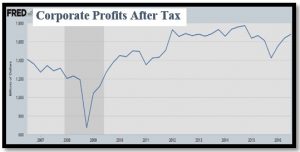

Corporate profits, for the year ending September 30, 2016, showed only slight improvement. In fact, corporate profits have been disappointing for years – there have been no meaningful gains in corporate profits for the past five years though the stock prices have on average increased by 90%! The stock price gains, in this perspective, may seem primarily to be a function of the Fed’s easy monetary policy which has made stock alternatives, such as bonds, so unattractive. The standard market valuation metric, the P/E (price to earnings ratio), now is about 24, far above the historic average of 15; this indicates that corporate stock prices are uncommonly high relative to corporate profits.

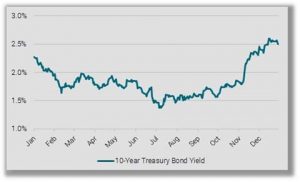

Yields on U.S. government bonds touched new lows in July as investors grappled with aftershocks of the U.K.’s vote to leave the European Union; the 10-year yield settled as low as 1.4%. By year end, after the US elections raised hopes of increased economic growth, the 10-year yield rose dramatically to 2.4%, which in turn depressed bond total returns for the year.

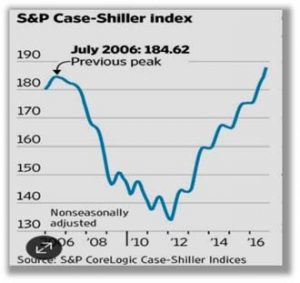

According to the S&P Case-Shiller index, US home prices rose 5.5% over the past year. Prices now have climbed back above the record reached more than a decade ago, though adjusted for inflation the index still is about 16% below the 2006 high

Fed officials voted unanimously last month to lift their benchmark federal-funds rate by a quarter percentage point to a range between 0.50% and 0.75%. It was the first Fed rate increase since December 2015. It is expected that the Fed will raise rates by another 0.75% in 2017.

Political news dominated the 2016 financial year’s headlines – first, Brexit, and then the US Presidential election.

BREXIT

Britons voted June 23rd to sever ties with the European Union. The stunning vote plunged world financial markets into turmoil (which they later recovered from) and, with its systemic negative effects on finance, trade, and labor mobility, Brexit marks a major setback for globalization and is an international economic and political development of profound significance. While it is too soon to clearly understand the implications as the Brexit process is still unfolding, the Bank of England and others have clearly stated that Brexit would be a major economic drag on the UK and its trading partners.

US PRESIDENTIAL ELECTION

Donald J. Trump was elected President of the United States in November and, as well, Republicans retained control of the House and the Senate. The consequences of a Trump presidency will be many and the economic ones will be consequential. The Trump administration aims to fundamentally change the economy – including a big surge of spending on infrastructure, realignment of trade policies, deep tax cuts, immigration reform and financial deregulation.

Donald Trump’s election as President of the United States may also portend the end of Pax Americana – the international order of free exchange and shared security that the US and its allies built after World War II. If Trump is serious about putting “America first,” his administration may shift US geopolitical strategy toward isolationism and unilateralism; in turn, that may raise risks of global instability.

The impacts of the new Trump economic policies are far from clear: In addition to an expected increase in economic activity, these policies may result in higher inflation, higher interest rates, lower corporate profits, and challenges for the performance for both stocks and bonds.

Two days after Trump was elected, the Dow Jones average hit a new record high – and has since set over a dozen more daily records. But whether Trump’s policies will be good for investments, and the economy, over the longer term is yet to be told.

FIDUCIARY DE-REGULATION

President Trump supports repeal of the 2010 Dodd-Frank Act, the massive regulatory response to the recent financial crisis. Moreover, one of Trump’s top Wall Street supporters – Anthony Scaramucci, recently named a senior assistant to the President – also has promised that the Trump Administration will end the new Department of Labor (DOL) investment fiduciary advice rule. Scaramucci said the new DOL measure, which requires financial advisers to act in the best interests of their clients concerning retirement accounts, is an example of government overreach that would divert too much capital into low-cost passive index funds.

“Your 401(k) doesn’t need a Federal babysitter” was the title of his recent Wall Street Journal article condemning the fiduciary rule. “We’re going to repeal it,” Mr. Scaramucci said. It is “unnecessary”, an effort to help “file class-action suits”, and the Trump administration would instead impose a “self-auditing process” for financial advisers which he argued would lead to “better client safety” and “less governmental oppression”.

Congressional Republicans also have expressed broad support for blocking the Obama administration’s investment fiduciary advice rule.

Whether the fiduciary rule is repealed or not, GFM remains a fiduciary to its clients at all times, without exception.

Looking Ahead

The current economic landscape suggests that investors should continue to expect more modest returns than usual and remain defensively positioned. Our reading of the latest economic and, moreover, political indicators suggests increased risks ahead as very new leadership brings very new policies to Washington. Bottom line – we continue to recommend that investment portfolios lower normal allocations to stocks, emphasize high quality securities (both stocks and bonds), and include meaningful inflation hedges.