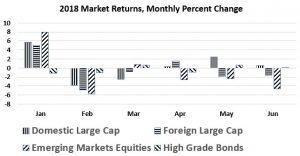

During the first half of 2018, equity markets around the world logged meager gains while returns to fixed-income investments were negative. In sum:

- US stocks rose 2.7%.

- Global stocks gained 0.2%.

- Investment grade bonds lost 1.6%.

- Small cap stocks beat large cap stocks by 3%.

- Foreign stocks lost 2.8%.

- Emerging market stocks dropped 7%.

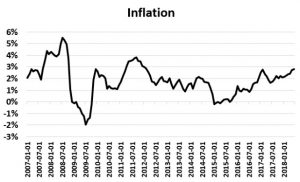

- Inflation accelerated to 1.8% in the US (3.6% annualized rate).

Equity market returns during the first half of 2018 were much lower than the pace of 2017, when stocks around the world earned over 20%, and bond returns were also far lower than the positive 3.5% earned in 2017. What accounts for the difference is impossible to say with precision, but there are numerous suspects:

- Stock valuations remain exceedingly high and investors are noticing; in the US in particular, stocks have only been more expensive than now prior to the Tech Bubble burst in 2000.

- Interest rates have risen, which puts downward pressure on stock and bond prices. US Federal Reserve statements indicate they plan to continue moving interest rates higher.

- Inflation also has moved up, which tends to lead to higher interest rates.

A trade war started by President Trump has increased anxiety among investors and others who anticipate a likely decrease in economic activity as a result.

Strong Economies for a While

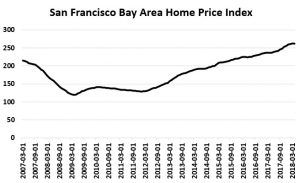

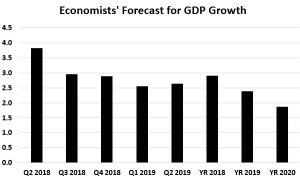

The US economy performed very well during the first half of 2018 and GDP growth is expected to be near 3% for the year. Unemployment, at 3.9%, is at a 17-year low. US mortgage rates have risen but remain relatively low at 4.5%. Globally, growth is expected by the International Monetary Fund to be near 4% in 2018. Corporate profits are robust and national home prices have generally returned to peak levels last seen prior to the housing crisis of 2007. In the San Francisco Bay Area, home prices are now well above the 2007 peak.

The chart to the right, however, shows that the rapid pace of economic growth is not forecast by leading economists to continue much longer as the impact of the 2017 tax cut stimulus fades. As well, not all macroeconomic news is positive: The Medicare trust fund is now forecast to be exhausted in 2026, three years earlier than expected; the Social Security trust fund is forecast to be exhausted in 2034, again three years earlier than previously expected; and the Congressional Budget Office is forecasting Federal budget deficits reaching nearly $1 trillion yearly in 2019 and beyond, primarily a result of last year’s tax legislation which slashed corporate and personal tax rates. The national debt, historically accumulated, now stands is $21 trillion. The Gross Domestic Product, or national income of the US as a whole, is $18 trillion. At this pace, the annual national deficit will exceed 5% of GDP. As interest rates rise, the debt servicing costs of the national debt are forecast to increase dramatically.

Inflation and the Fed

The chart of inflation over the past decade shows the trend over the past three years of inflation moving up significantly, from a few months of negative inflation in 2015 to a current rate of near 3%. Inflation is targeted by the Fed at 2%, so the current rate and trajectory are being responded to by a Fed policy of gradually increasing interest rates in order to cool the economy and avoid excessive inflation. How much higher inflation will reach is unclear; while the Fed plans to increase interest rates to dampen inflation, their plan has drawn criticism from President Trump, breaking the tradition of Presidents not commenting on Fed policy in deference to its independence.

Reducing Financial Protections and Regulations

The financial advisor fiduciary rule put in place by the Obama Administration’s Department of Labor is no longer operative. A federal appeals court ruled in June that the Labor Department overstepped its authority in requiring financial professionals to act in their clients’ best interests. In its place, the Securities and Exchange Commission has put forward a fiduciary rule proposal that is more to the tastes of the current administration and the financial services industry. The 916 page proposal has been characterized by fiduciary advocates as further obfuscating the distinction between fiduciary advisors and financial sales professionals

Congress also passed, and the President signed, new legislation reducing the financial oversight of the banking industry that was put in place after the Great Financial Crisis of 2007. Supporters say the bill will boost growth, while critics say it raises the risk of another financial meltdown.

The Consumer Financial Protection Bureau was also subject to new direction from the Administration. The CFPB now has backed away from consumer protection initiatives, sharply reduced its now self-described “wasteful spending” budget and re-focused the agency’s enforcement authority to “prevent actions that unduly burden the financial industry and consumer choice.”

“Trade Wars Are Good, And Easy To Win.”

President Trump came into office with a highly critical view of international trade that is radically different from the post World War II views held almost universally by Republicans, Democrats and mainstream economists. In order to address what he views as unfair trade practices, the President has publicly insulted allies, announced a series of major tariffs, and threatened to do much more. In response, US trading partners subject to new tariffs (e.g., Canada, the European Union and China) have responded in kind, placing tariffs on American exports. The magnitude of the tariffs imposed to date is relatively moderate and the tariff impacts are just now being recognized, but the symbolism is quite large and over time so may be the economic consequences as the dimensions of President Trump’s threats now encompass trade flows of $1 trillion. By acting in a unilateral fashion, the Administration appears to be abandoning a multilateral global trading system that America was central to building, and that perceived realignment is creating profound distrust among our trading partners and traditional allies.

President Trump has said, contrary to historical experience, that “Trade wars are good and easy to win.” But evidence in America of lost jobs and lost overseas markets is already being seen. A trade war may be the biggest risk currently to both economic activity and stock market prices; it may just open a Pandora’s Box of chaos and ill-will around the world.

It is instructive to consider the potential parallels between President Trump’s trade policy and America’s last and disastrous tariff legislation which was coincident with the 1929 Stock Market Crash and Great Depression of the 1930s. That previous tariff legislation, termed “Smoot-Hawley” in honor of its key drafters, originated in the 1928 presidential campaign near a business cycle peak and was enacted in 1930. It was offered up by Republican politicians who wanted to appease key voting blocs and promised economic growth and prosperity. Backers of the tariffs turned-back criticisms by disparaging the views of “eminent economists” as “idiotic” and as irrelevant to “a matter of which they have not the slightest practical knowledge”.

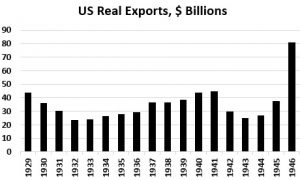

Tariff advocates argued that America’s trading partners would not respond, but they were wrong. Foreign countries retaliated with anger to the costs to them of American tariffs and by imposing heavy tariff duties on US exports. In fact, Smoot-Hawley trade restrictions spread around the world economy just as the global economy was sinking into a depression. As the League of Nations put it at the time: “The SmootHawley tariff in the United States was the signal for an outburst of tariff-making activity in other countries.” In the wake of the SmootHawley tariff, between 1929 and 1932 US exports fell almost 50% and imports fell about 40 percent. The lost exports equaled an estimated 34% of GDP. US exports did not again meaningfully pass the 1929 level until 1946. And ever since Smoot-Hawley, at least until the election of President Trump, tariff wars have been viewed universally as destructive. Presidents Truman, Eisenhower and Reagan, among others, severely criticized SmootHawley as “tragic”, “ruinous” and “destructive” for America and the world.

Looking Ahead

Investors should continue to plan realistically for relatively modest returns and more volatility. While foreign stocks are fairly priced, American stocks continue to be priced far above the norm relative to profits. As well, bond yields are rising and that will mean relatively low total bond returns until interest rates plateau.