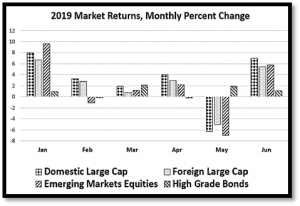

Equity and bond markets around the world during the first half of 2019 logged solid gains while worries of a global economic trade-war and slowdown kept markets on edge. In sum:

- US stocks rose 18.5%.

- Global stocks gained 16.0%.

- Foreign stocks returned 14.0%.

- Emerging market stocks advanced 11.0%.

- In terms of investment styles and sectors, growth stocks beat value, US stocks beat foreign, large stocks beat small, and longer-term bonds beat shorterInvestment grade bonds gained 6.1%.

- Inflation remained at a 1.8% annualized rate.

In terms of investment styles and sectors, growth stocks beat value, US stocks beat foreign, large stocks beat small, and longer-term bonds beat shorter. Driving markets this year has been a US economy that continues to grow moderately with very low interest rates, inflation and unemployment. But going forward, context is critical: Though the US stock market is up 18% since January of this year, it stands only 2% higher than it was in January of last year. After a late 2018 stock market sell-off on fears of interest rate increases, this year stock prices have risen on the back of unexpected interest rate declines and the continuation of the current economic expansion, the length of which has surpassed the previous record set between 1991 and 2001.

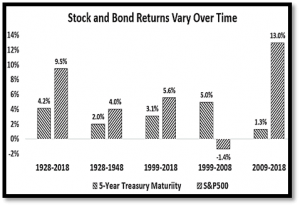

A continuation of strong advances for stocks is not guaranteed: stock market annual returns after the last stock market boom, that also coincided with the last historic economic expansion, were negative on average during the following ten years (see years 1999-2008, on chart to right)!

Moreover, economic growth in this expansion has averaged 2.3%, far lower than any other expansion in the last fifty years, while stock prices have advanced faster than the average during the previous expansions. The result of these factors is that the current US bull market is the second most expensive stock market in US history, with only the Tech Bubble market around 2000 being higher before it crashed.

The US stock market is now relatively priced (on a price-to-cyclical earnings basis) higher than it has been 92% of the time over the past 75 years. In hindsight, it may be that the most distinguishing feature of this bull market will be seen to be the policy by Central Banks around the world of keeping interest rates extremely low and which drove money out of fixed income and into stocks.

This historically expensive stock market, characterized by stock prices almost twice the norm, coincides with an historically long economic boom, an historically long bull market, historic highs for corporate earnings, and historically low interest rates. In other words, we have recently experienced a “Perfect Storm” of positive support from key but volatile economic drivers that always come back to earth (a phenomenon known as “mean reversion” in finance).

Elevated Investment Risk

At this moment, the risks to markets and economies are many and they may both cause economic stress as well as constrain policymakers from responding more forcefully to an economic downturn. The risks include:

- US trade wars with China as well as with allies in Europe, Canada and Mexico that depress economic activity and are costing American households an estimated (New York Federal Reserve) $840 yearly in tariff costs, and which have been identified by the Fed as a top macroeconomic risk;

- A possible disruption of the flow of one-fifth of global oil supplies because of tensions with Iran;

- A debt crisis in Washington, just now temporarily addressed with more new debt financing, with a surging US budget deficit (up 40% this year to about $1 Trillion a year), an unprecedented national debt (about $67,000 per capita and climbing), interest payments that by 2023 will exceed the military budget, and looming insolvency of Medicare and Social Security trust funds;

- A general lessening of economic activity in the US and around the world and a very sharp drop in global trade growth;

- An earnings recession, which is now being seen in the US, while stock prices reflect expectations of continued rapid earnings growth;

- A current inverted yield curve, where short-term Treasury bonds yield more than longer-term Treasury bonds, the first since 2007, that historically has often preceded a coming recession and impacts business and market psychology;

- A chaotic Brexit disrupting European economies;

- Interest rates that are extremely low and cannot be lowered much further to provide stimulus to an economy in recession;

- And, a US election campaign where economic grievances among Democrats have generated widespread support for much higher taxes on businesses and the wealthy, stronger anti-trust policies, expanded social spending, and a much higher minimum wage.

If you feel that you are experiencing a form of economic outlook whiplash, that may be because the economic outlook has changed so dramatically in such a short period of time. It was just late in 2018 that Fed Chair Powell said that the economy was in great shape and modestly higher interest rates were appropriate for the coming year of 2019 to avoid the economy overheating and causing unwanted inflation. But by late January of this year, that previous view was very old news as the Fed announced a dramatic policy reversal and pause to rate increases. Now, in July, the Fed seems ready to cut interest rates in response to newly perceived signs of slowdown.

For portfolios following our Index Strategy, 2019 returns during the first half of the year have been strong and closely reflected stock and bond market returns. Portfolios following our Value Strategy are not designed to closely track market performance but to add value over longer market cycles. Our Value Strategy investment approach is grounded in long-term market forecasts, which do not fluctuate wildly, and an investment discipline based on insights drawn from almost a century of data from markets in the US and around the world. In recent times the Value Strategy approach, which emphasizes relatively low-priced stocks, has lagged the market averages. Value strategies historically have been among the most profitable investment approaches, though they have been out of favor at times and then came back strongly.

Trump Administration’s War on Consumer Financial Protection

The Trump Administration has made it a mission to oppose consumer financial protection laws and institutions. The first foray was to place the Consumer Financial Protection Bureau (CFPB) under the supervision of Mick Mulvaney, a former congressman who opposes the existence of the CFPB and who now is President Trump’s Chief of Staff. Mulvaney turned the agency away from its consumer financial protection mission and into an agency protecting financial service companies from undue regulation.

Most recently, the Securities and Exchange Commission (SEC), with all members appointed by President Trump, promulgated “Regulation Best Interest” (Reg BI), a near-impossible to comprehend 1500-page regulation of stock-brokers and investment advisors which is breath-taking in its effort to obscure the difference between stock-brokers, who are salespeople, and investment advisors, who are fiduciaries. The most serious failing is that Reg BI continues to permit individual financial representatives to be licensed for both roles and to act in either or both roles with the same client. It is obviously impossible for an individual financial representative to be primarily loyal to two parties whose interests are adverse, but politics and the economics of the brokerage industry have resulted in the SEC permitting what is termed “dual registration”. No rule governs how dual registered representatives move between roles (or “hats”) and no disclosure is needed. Most of the 1500 pages of Reg BI tries to resolve the contradiction, but the effort has resulted in an unclear regulation that neither consumers nor professionals can comprehend.

The details of Reg BI are too vast and complex for this letter to encompass, but here is the essential meaning for retail investors of Reg BI as perceived from the positions of interested parties: All the financial service companies and their trade groups have applauded Reg BI, while consumer protection groups (such as AARP and Consumer Federation of America) and professional investment fiduciary organizations (such as the CFP Board of Standards) have denounced Reg BI as a deception intended to protect stock-brokers rather than investors.

The Reg BI vote at the SEC was 3-1, with SEC Commissioner Robert Jackson Jr. voting “no” and stating in dissent: “Rather than requiring Wall Street to put investors first, today’s rules retain a muddled standard that exposes millions of Americans to the costs of conflicted advice”. As well, the SEC’s Investor Advocate found Reg BI wanting: “[Reg BI] likely will not achieve its original goal of preventing the financial harm that results from investor confusion about the differences between investment advisers and broker-dealers…The most worrisome aspect of Reg BI is that it will allow broker-dealers and their associated persons to market themselves as acting in the best interest of their customers”.

Grossman Financial Management’s policy regarding the fiduciary standard is simple and unchanged; we always serve clients in a fiduciary capacity.

Looking Ahead

Portfolio asset class strategy is the dominant factor driving investment returns and in constructing the optimal portfolio considering investor objectives. Investors in stocks should expect much more modest returns going forward than have been experienced so far in 2019. Though foreign stocks are reasonably priced, American stocks are trading at levels that may be difficult to support and from which investors should expect relatively low long-term returns. Bond yields are low and the trajectory of rates is unclear; that points to the need for a well-diversified bond portfolio broadly exposed to fixed income sectors.